Online Games : Valuation & Classification of Service : GST Law of India

Por um escritor misterioso

Last updated 23 maio 2024

Online Games : Valuation & Classification of Service : GST Law of India

Get To Know about GST Registration for Freelancers

gst on online gaming: Online gaming companies to collect 28% on full bet value, offshore platforms to be GST registered from Oct 1 - The Economic Times

Death By GST? Why Real-Money Gaming Startups Are Crying Havoc

How 28% GST can be the death knell for India's gaming industry

India's New Gaming Tax Plan Demands $12B From Online Operators

gst: Offshore gaming apps lure users with 'No GST' carrot - The Economic Times

GST on online gaming: Online gaming, casinos set to attract 28% GST: All you need to know - The Economic Times

Online Games: Valuation & Classification of Service: GST Law of India

Uniform 28% tax on online gaming: What the GST Council's decision says, its implications

CBDT notifies CGST (Third Amendment) Rules, 2023

Value-added tax - Wikipedia

Recomendado para você

-

10 Best Poki Games - GeeksforGeeks23 maio 2024

10 Best Poki Games - GeeksforGeeks23 maio 2024 -

Cartoon Network Games, Free Kids Games23 maio 2024

Cartoon Network Games, Free Kids Games23 maio 2024 -

10 Free Online Games to Teach Third Grade Math Skills - eSpark23 maio 2024

10 Free Online Games to Teach Third Grade Math Skills - eSpark23 maio 2024 -

Connect 2 - Online Game - Play for Free23 maio 2024

Connect 2 - Online Game - Play for Free23 maio 2024 -

Play Free Online Games, Best Games23 maio 2024

Play Free Online Games, Best Games23 maio 2024 -

All Games, Play online games APK for Android Download23 maio 2024

All Games, Play online games APK for Android Download23 maio 2024 -

Games and puzzles - Mind23 maio 2024

Games and puzzles - Mind23 maio 2024 -

:max_bytes(150000):strip_icc()/kidsfunonlinegames-featured-5bff772ac9e77c00264b1387.jpg) The 8 Most Fun Online Games for Kids in 202323 maio 2024

The 8 Most Fun Online Games for Kids in 202323 maio 2024 -

Online gaming in young people and children23 maio 2024

Online gaming in young people and children23 maio 2024 -

Online games23 maio 2024

você pode gostar

-

Nanatsu No Taizai Openings/Endings (1-9)23 maio 2024

Nanatsu No Taizai Openings/Endings (1-9)23 maio 2024 -

Farming Simulator 22 - YEAR 1 Bundle | Download and Buy Today - Epic Games Store23 maio 2024

-

Desapego Games - Roblox > FRUTA QUAKE BLOX FRUITS!23 maio 2024

Desapego Games - Roblox > FRUTA QUAKE BLOX FRUITS!23 maio 2024 -

Far Cry 2 (2008)23 maio 2024

Far Cry 2 (2008)23 maio 2024 -

COMO INVOCAR O RIP INDRA NO SEA 3 DO BLOX FRUITS - GUIA COMPLETO23 maio 2024

COMO INVOCAR O RIP INDRA NO SEA 3 DO BLOX FRUITS - GUIA COMPLETO23 maio 2024 -

Rogue Company: Elite23 maio 2024

-

Ding Liren makes chess history as China's first male world23 maio 2024

Ding Liren makes chess history as China's first male world23 maio 2024 -

John Pork is calling: Anthropomorphic pig emerges as big new TikTok trend23 maio 2024

John Pork is calling: Anthropomorphic pig emerges as big new TikTok trend23 maio 2024 -

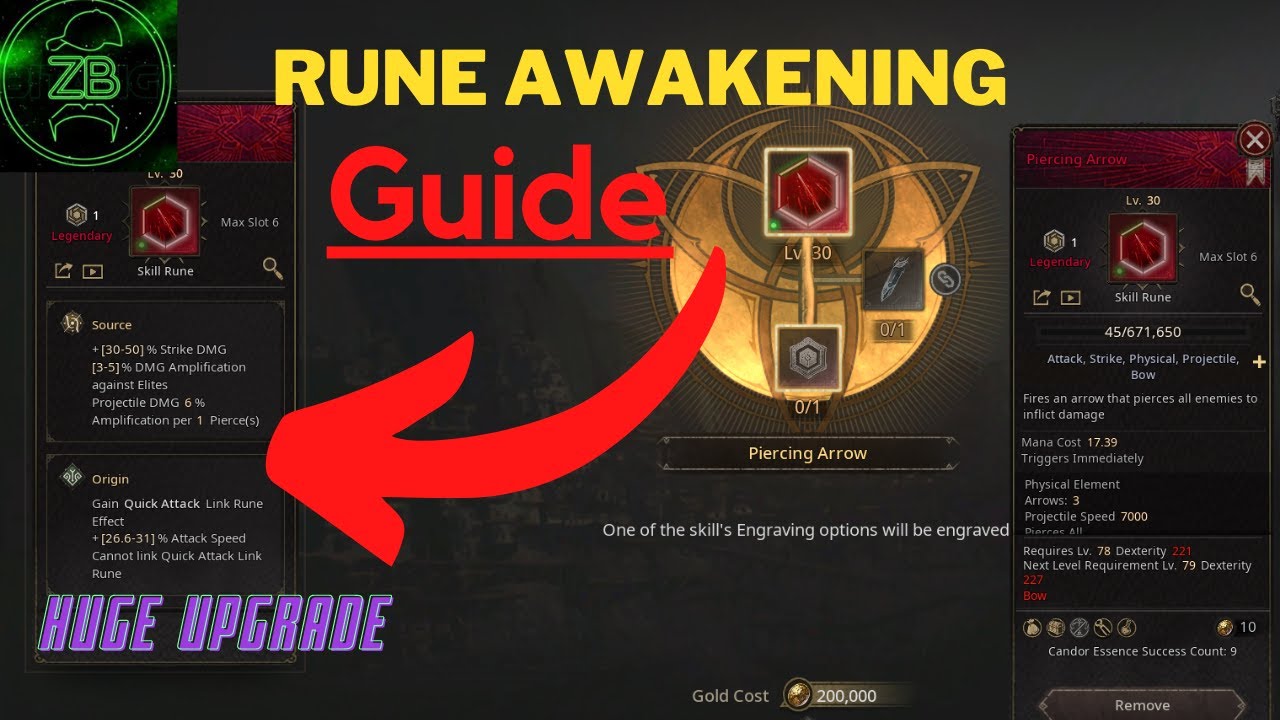

Undecember - Rune Awakening Guide23 maio 2024

Undecember - Rune Awakening Guide23 maio 2024 -

Crochê Para Barbie - Vestidos de Princesa Para Bonecas #123 maio 2024

Crochê Para Barbie - Vestidos de Princesa Para Bonecas #123 maio 2024